Bitcoin's New and Old Whales in Focus

In the ever-evolving cryptocurrency market, Bitcoin remains a focal point for investors both new and old. The latest analysis by @cryptoquant_com draws attention to the dynamics between new whales, who have entered the market less than 155 days ago, and old whales, who have held onto their assets for longer. These groups, along with Binance traders, play key roles in shaping weekend price trends. 1

New whales, despite a slight decline of 3.28% in their base cost, are accumulating Bitcoin, demonstrating strong confidence in its long-term value. Long-term holder whales continue to maintain a steady grip on their investments, even with profits soaring up to 115.54%. Their decision to hold signals expectations of further price increases. Meanwhile, Binance traders are known for quick profit realization, leading to short-term volatility in the market. This interplay among different investor groups underlines a potential trend towards market stability and imminent price growth. 1

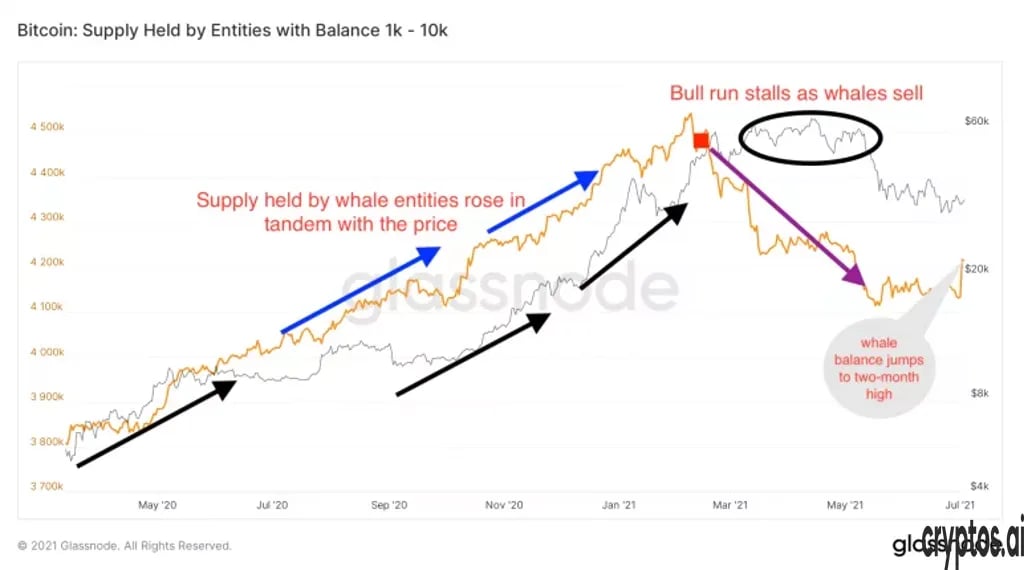

A graph depicting realized prices versus whale activity indicates that whale movements are reliable indicators of Bitcoin’s future prices. As whale activity sparks upwards, market predictions align with rising Bitcoin prices. The absence of panic selling among miners suggests a calm outlook, as they seem inclined to hold or gradually sell to sustain profits without disrupting the market.

This explanation by @IT_Tech_PL elucidates how the collaboration between old and new investors and their market actions are navigating Bitcoin towards increased stability. As old whales hold, and new investors purchase aggressively, the market seems poised for a phase of relative calm and potential growth.

Frequently Asked Questions