Bitcoin ETF Sees Significant Net Inflows

The Bitcoin spot ETF market witnessed considerable financial movements on December 31, with a net inflow of $5.3181 million. 5

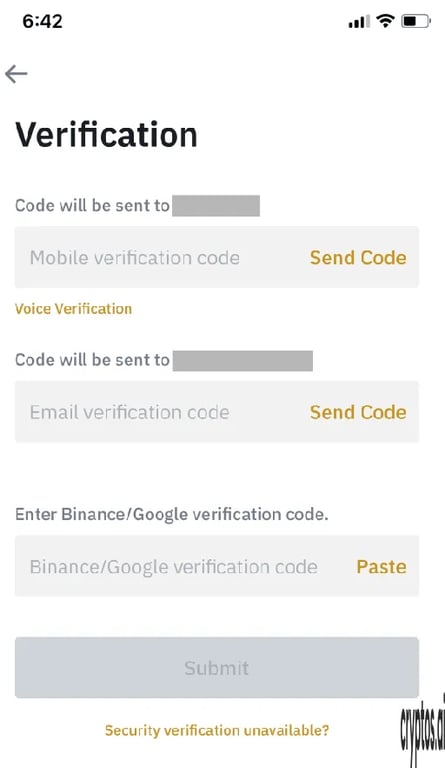

Notably, the Fidelity ETF FBTC emerged as a significant player, experiencing a net inflow of $36.8115 million. The substantial increase in fund flow underscores the growing interest and confidence from investors in the Bitcoin ETF sector.

As of the reporting date, the total net asset value of the Bitcoin spot ETF stands at a formidable $105.401 billion. This metric highlights the robust engagement of capital in Bitcoin-driven financial vehicles, reflecting their integral role in the expansion of cryptocurrency investment opportunities.

The rising inflow and asset value figures indicate a shifting trend towards traditional financial instruments like ETFs to gain exposure to Bitcoin. Such dynamics also imply heightened institutional participation and potentially a wider acceptance of Bitcoin as a genuine asset class in mainstream finance.

These developments mark a continuation of an evolving landscape where cryptocurrencies are increasingly merging with conventional financial markets, offering diversified channels for investors seeking exposure to digital assets.

Understanding these shifts can provide critical insights into the broader implications for financial markets and the sustained integration of cryptocurrency in global economic systems. Regular updates from industry insiders such as @WuBlockchain help navigate these dynamic economic terrains.

Frequently Asked Questions

WuBlockchain·5 months ago

WuBlockchain·5 months ago WuBlockchain·5 months ago

WuBlockchain·5 months ago WuBlockchain·6 months ago

WuBlockchain·6 months ago